CONTRIBUTIONS

Different benefits apply to former Gas Scheme members. Please click here for more information.

This is an overview of paying contributions into the Group.

Members’ contributions

Since 6 April 2016, the standard rate of pension contributions is 8% of your salary*. Income tax relief is automatically given at your highest marginal rate on the whole of your contributions. You don't need to do anything to claim the relief.

Contributions normally cease after 40 years' contributory service. Employees who joined the Scheme before 1 April 1988 have a normal pension age of 60, and a right to carry on working. Contributions cease at age 60, or before, if pensionable service reaches 40 years.

*‘Protected persons’ pay contributions of 6% of salary. If you have paid a lower rate of contributions (either 3% or 5%) there may be a reduction in the benefits payable.

How much does National Grid pay?

National Grid pays contributions of at least twice the member’s contributions, together with any additional contributions required as a result of the actuarial valuation. The rate of employer contributions is published in the NGE Group’s Annual Report and Financial Statements available in the library below.

Tax relief on your pension contributions

Your take-home pay might not be reduced by as much as you think as there is income tax relief on your pension contributions.

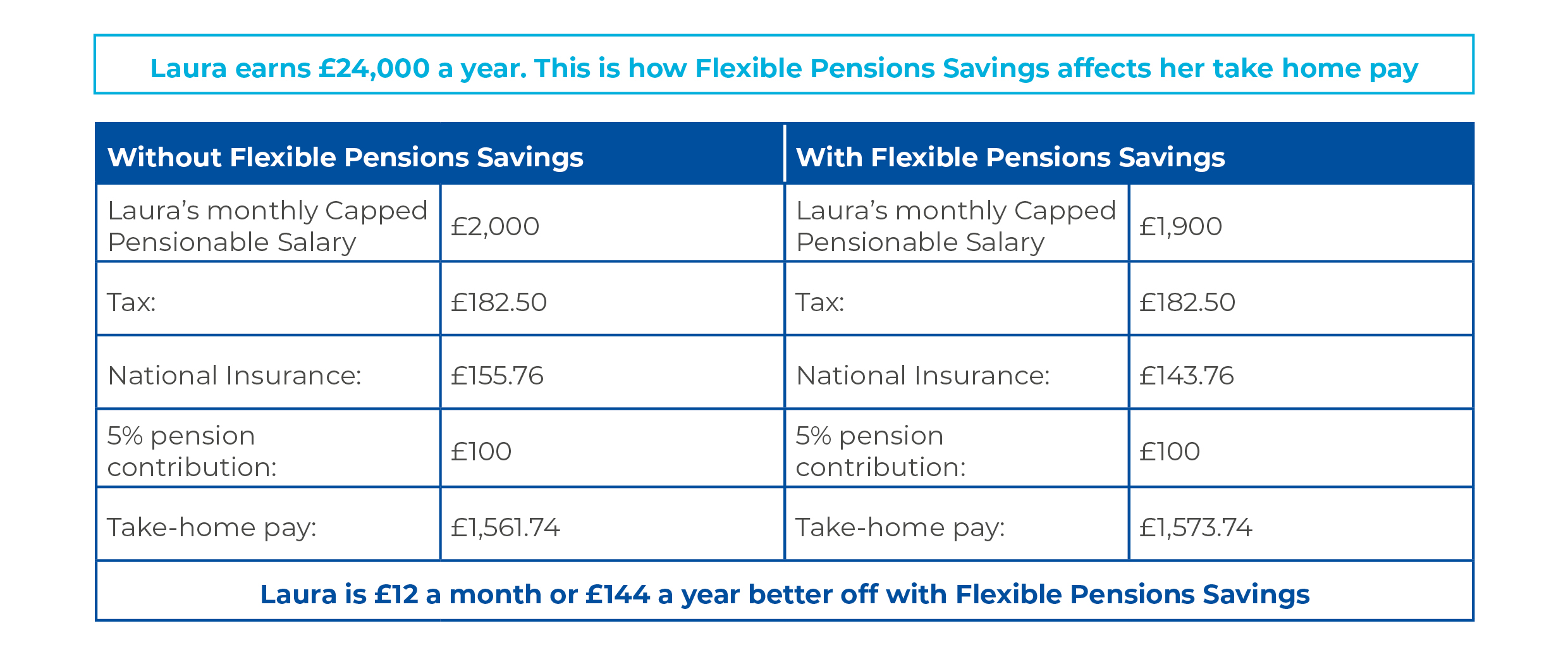

Some years ago the Company introduced Flexible Pensions Savings and if you were eligible at the time, you would have been enrolled. If you haven’t opted out in the interim, you will make your pension contributions through Flexible Pensions Savings, which means you’ll benefit from National Insurance (NI) savings.

With Flexible Pensions Savings, your salary is reduced by an amount equivalent to your contributions, so you pay income tax and NI on a lower amount. In return, your employer will pay your contributions on your behalf.

Here’s an example of how it works in practice:

(The illustration above is provided as an example based on tax and NI rates applicable at 2018/19, so if tax and NI rates have changed since then the savings quoted will have changed accordingly.)

A small number of members may not benefit from Flexible Pensions Savings, for example, if you’re over the State Pension Age or you earn less than the Lower Earnings Limit*.

If you’re eligible and take part in Flexible Pensions Savings then you’ll automatically re-join every year. You have the opportunity to de-select Flexible Pensions Savings through the flexible benefits plan at any time. Please note, you can still use your pre-Flexible Pensions Savings salary when applying for a mortgage or other financial products.

To see if you are signed up for Flexible Pensions Savings, you can check your payslip. ‘Flexible Pen Savings’ will be listed under payments as a deduction equal to the amount of pension contributions which are paid on your behalf; ‘Total Flexible Pensions Savings’ under ‘Year to Date’ will show the total amount paid this tax year.

*The Lower Earnings Limit is set by the Government, and is the threshold used to determine if you qualify for certain State benefits and if you need to pay NI contributions.